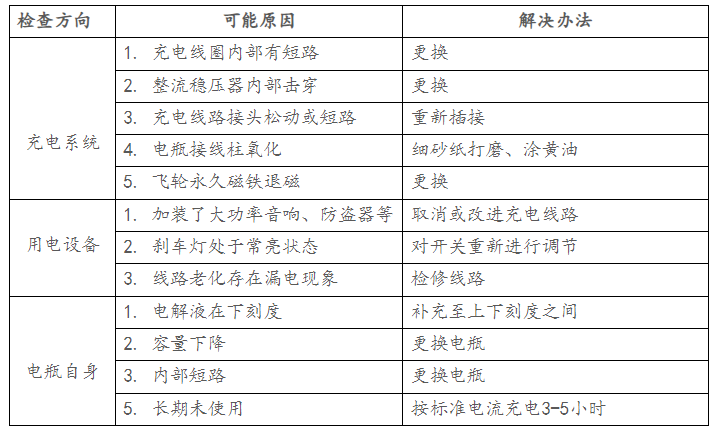

Diagnostic procedure for insufficient battery charge

Published Time:

2023-06-16 10:02

Source:

A motorcycle's charging system consists of a magneto, a rectifier-regulator, and a battery. A problem with any one of these components will result in a dead battery and failure of the electric starter.

The magneto needs to provide sufficient electrical energy. It consists of a magnet rotor and a coil stator. Its performance is affected by the strength of the magnet's magnetic field and the technical condition of the coil, such as whether there is a partial short circuit or a partial open circuit, which can be checked with a multimeter.

The function of the rectifier-regulator is to rectify and regulate the AC power output from the magneto into suitable DC power to charge the battery.

The function of the battery is to store electricity. Its failures include: 1. Reduced capacity; 2. Damage. Internal partial short circuits make it difficult for the charging voltage to rise to the specified value. After several uses of the electric starter, the battery is depleted, or after being left for a period of time, the electric starter cannot be used.

Previous Page

Next Page

这里是标题一h1占位文字

Related News

No. 101, Area B, Guohong Industrial Park, Wuyi Village, Lishui Town, Nanhai District, Foshan City

mavis.zou@yuxingmotor.com

COOKIES

Our website uses cookies and similar technologies to personalize the advertising shown to you and to help you get the best experience on our website. For more information, see our Privacy & Cookie Policy

COOKIES

Our website uses cookies and similar technologies to personalize the advertising shown to you and to help you get the best experience on our website. For more information, see our Privacy & Cookie Policy

These cookies are necessary for basic functions such as payment. Standard cookies cannot be turned off and do not store any of your information.

These cookies collect information, such as how many people are using our site or which pages are popular, to help us improve the customer experience. Turning these cookies off will mean we can't collect information to improve your experience.

These cookies enable the website to provide enhanced functionality and personalization. They may be set by us or by third-party providers whose services we have added to our pages. If you do not allow these cookies, some or all of these services may not function properly.

These cookies help us understand what you are interested in so that we can show you relevant advertising on other websites. Turning these cookies off will mean we are unable to show you any personalized advertising.